- #New pan card correction form free download pdf how to

- #New pan card correction form free download pdf pdf

- #New pan card correction form free download pdf verification

Ration card having a photograph of the applicant or Aadhaar Card issued by the Unique Identification Authority of India orĮ.

#New pan card correction form free download pdf pdf

It may take up-to 7–9 days to have it processed and you will get the PDF from PAN website with the corrected name.Step 2: Once the name change is done, again verify your name in Income tax portal after a week as it will take sometime to get your name updated in the Income tax department server.Step 3: After 2 weeks, login to EPFO website and proceed with updating your KYC for PAN card and it will get updated instantly and will go for employer/IT department approval.Step 4: If you are still unable to get the KYC completed for PAN card then you have to raise a grievance in EPFO Grievance portal to get it rectified.Again follow Step 3 to update the KYC for PAN card in EPFO website.Document acceptable as proof of identity, address, and date of birth as per Rule 114 of Income Tax Rules, 1962 Proof of IdentityĪ. If the name in Income tax department does not match with Aadhar card then you need to apply for name correction in PAN card website. It should match with the name printed in Aadhar card.

Step 1: First validate your name on the PAN card from Income Tax department website and enter exactly as it is mentioned. Once your OTP is confirmed, your PAN application is successfully submitted.Do note that at times, you might not see acknowledgement screen after confirming the OTP for technical reasons, there is no need to worry as your application is still is submitted and you would receive acknowledgement number on your mobile/email which you could use to track your application.Hope that answers your question! In case of further queries/assistance, feel free to write to me at How do I correct the error on the EPF website that says, “Name against UAN does not match with the NAME in Income Tax Department”? Once you’ve selected a payment method and completed it(in case of online payment) you’ll be prompted to enter the OTP received on your Aadhaar registered mobile number.

If you selected e-KYC, Aadhaar will be selected by default and will be completed after the payment.Once you’ve reviewed the application, you’ll be asked to select a payment method.

#New pan card correction form free download pdf verification

Select e-PAN using which you’ll receive a PDF version of your PAN card in your email.Add only your mobile number next and don’t add the address as it’s only meant to be filled in case you need a change.There will be a declaration on the next page - once you complete it you’ll require to complete the document verification part. Note down the temporary token number generated on the next page.Next - there are 3 options to submit proofs for Identity, Address and Birth verification -Digitally through e-KYC & e-SignUpload scanned Images through e-SignForward documents PhysicallyYou could simply do e-KYC using your Aadhaar and doing so wouldn’t require to submit other documents for proof purpose, all you need is to verify your Aadhaar with registered mobile number and verify it using OTP.Next, you'll be asked to choose if you need Physical PAN or digital(e-PAN).

#New pan card correction form free download pdf how to

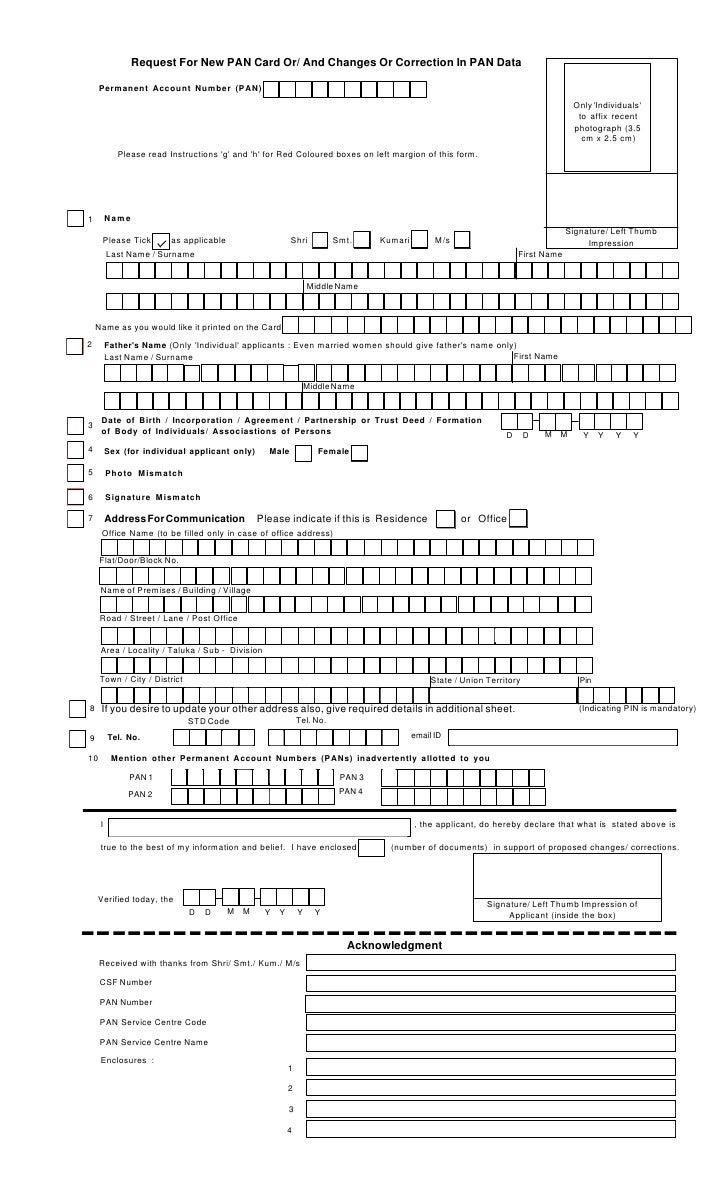

I will detail out the steps on how to apply for a PAN reprint in this answer.You can also opt to go for the easier, very obvious way to get a soft copy of your PAN by simply taking a good quality picture of your Physical pan card and use it for verification purposes.Go to the TIN-NSDL New PAN application page to get started with the application process.Select Changes or correction in existing PAN Data/Reprint of PAN card and Individual in the category.Click submit and proceed after adding personal details as asked.

You can apply for a reprint of your existing PAN card and choose the e-PAN mode of delivery, in which case you would get a PDF version of your PAN card delivered to your email.

0 kommentar(er)

0 kommentar(er)